The Opening Range Breakout Strategy in the Indian Stock Market

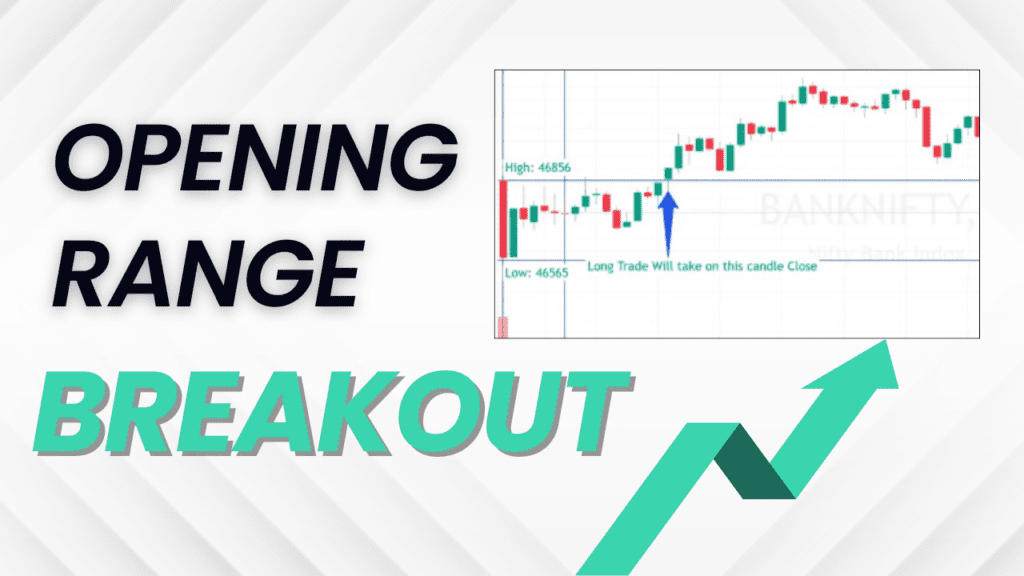

Many Indian stock market traders rely on the Opening Range Breakout (ORB) strategy. This technique focuses on the price action during the first hour of trading. By analyzing this initial movement, traders aim to identify key support and resistance levels. These levels can then be used to predict potential price breakouts and capitalize on significant price swings.

This article will provide a deep dive into the ORB strategy. We’ll explore its core principles, the advantages it offers, and a step-by-step approach for using it effectively in the Indian market. Clear examples and charts will be included to illustrate the concepts.

The Opening Range Breakout (ORB): Decoding Early Price Action :

The ORB strategy hinges on a simple idea: the first hour of trading can be like a compass for a stock’s price movement. Traders using ORB watch the stock’s highest and lowest prices during this time window. They then calculate a range based on these points, which helps them spot potential breakouts – moments where the price pushes decisively above or below this range. These breakouts can signal bigger price moves in the direction of the breakout.

There are a few reasons the ORB strategy is popular with Indian stock market traders :

- Easy to Learn: The ORB strategy is fairly simple to understand and use, making it accessible to both new and experienced traders.

- Works in Choppy Markets: Unlike some strategies that struggle in volatile times, ORB can be effective even when the market is up and down quickly. This can help traders feel more confident navigating uncertain conditions.

- Clear Signs for Trades: By focusing on the opening price range, ORB gives traders clear signals for when to buy (long) or sell (short). This can help them make decisions quickly and with more information.

- Riding the Wave: The ORB strategy helps traders catch price movements early by identifying breakouts from the opening range. This can allow them to potentially profit from the momentum of those moves.

Here’s a breakdown of how to use the ORB strategy in the Indian stock market :

- Pick Your Stock: First, choose the stock you want to trade. Let’s use the Nifty 50 for demonstration.

- Early Bird Gets the Worm: Focus on the first hour of trading, ideally with a 15-minute chart. Look at Nifty 50’s price movement on, say, April 15th, 2023. In that first hour, the Nifty 50 ranged from a high of 17,209 to a low of 17,121. This range helps us identify key levels: the high becomes potential resistance, and the low becomes potential support.

- Spotting the Breakout: Now we need to find the breakout level. If you want to buy (go long), watch for the price to break decisively above the high (resistance). If you want to sell (go short), watch for the price to break sharply below the low (support).

- Enter the Trade: Once you see a breakout, you can enter the trade. Buy (long) if the price breaks above the high, and sell (short) if the price breaks below the low. In our example, suppose the price dives below the low (17,121) around 10:30 AM IST. That might be your short entry point.

- Cut Losses and Take Profits: Here comes risk management. Set stop-loss and take-profit levels to limit losses and lock in gains. For example, place a stop-loss at the high (17,209) to limit potential losses on a short trade. You could aim for a profit target around 16,970 to 16,940, which is roughly a 1% profit based on the initial range (assuming a risk-reward ratio of 1:2).

- Keep an Eye on Your Trade: Always monitor the price action to find the best exit point. In our example, let’s say the price reaches the take-profit target of 16,945 around 3:25 PM IST.

- Exit the Trade: Once the price hits your take-profit level, sell your short position (or buy to close a long position) to secure your profits. In this case, we would exit at 16,945.

Risk Management for ORB Trades :

Stop-Loss Orders are Your Friend: Always set stop-loss levels to limit your losses if the trade goes against you. This helps you avoid emotional decisions and protects your capital.

Trade Smart, Not Often: Avoid overtrading. Stick to your trading plan and don’t get tempted to jump into every possible breakout signal. Discipline is essential.

Taking the ORB Strategy on Autopilot: Algorithmic Trading Software :

The ORB strategy can be automated using algorithmic trading software designed for the Indian market, like, EzQuant Algo Trading.

Here’s how EzQuant ORB software streamlines the process:

- Auto-Pilot for Repetitive Tasks: It automates things like finding opening range levels, placing trades based on breakouts, and exiting at planned levels.

- Customization is Key: You can set your own stop-loss and take-profit levels, as well as the number of shares you want to trade.

Algorithmic trading software offers several advantages:

- Trade Like a Machine, Not a Human: Automation removes emotions from the equation, helping you trade with discipline and consistency.

- Lightning-Fast Trades: These systems can execute trades at super speed, which is crucial in fast-moving markets.

- Free Up Your Time: By automating tasks, you have more time to focus on improving your strategy or other activities.

Explore EzQuant ORB Strategy Algo :

To learn more about EzQuant ORB software and its features, visit Our website : https://ezquant.in/

Click Here to Automate the Range Breakout Software.

Conclusion :

In summary, employing algorithmic trading tools such as EzQuant can prove to be a highly efficient method for automating the ORB trading strategy within the Indian stock market. Offering a paper trading functionality along with adaptable settings, EzQuant furnishes traders with a robust instrument to both evaluate and execute their ORB strategy.