Range Breakout Strategy Algo

- Discover the future of trading with our ORB Strategy Algo Tool. Based on Opening Range Breakout principles, it offers automated scanning, customizable parameters, and real-time alerts for seizing market opportunities. Enhance your trading strategy with this innovative solution.

Watch it Perform in Real Market.

Witness real-market performance with our ORB Strategy Algo Tool. Experience live scans, customizable parameters, and instant alerts. Elevate your trading game with this cutting-edge solution.

Range Breakout Explained

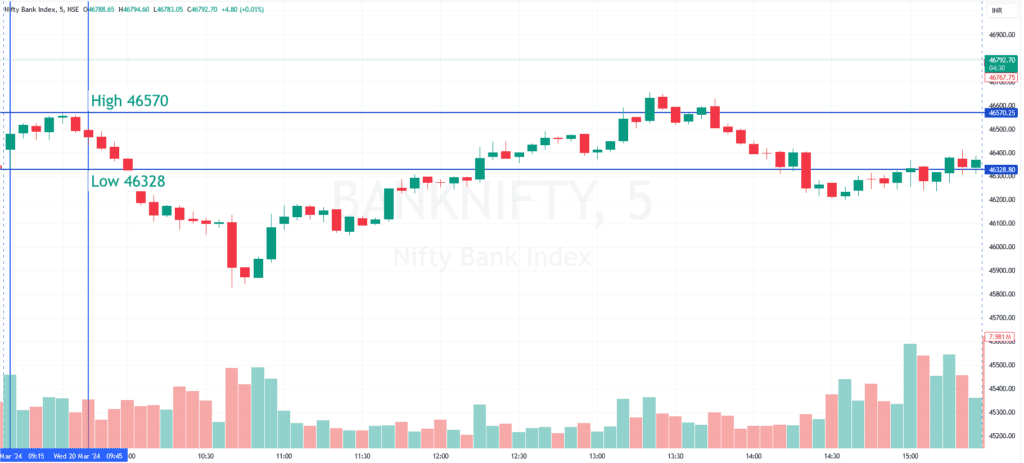

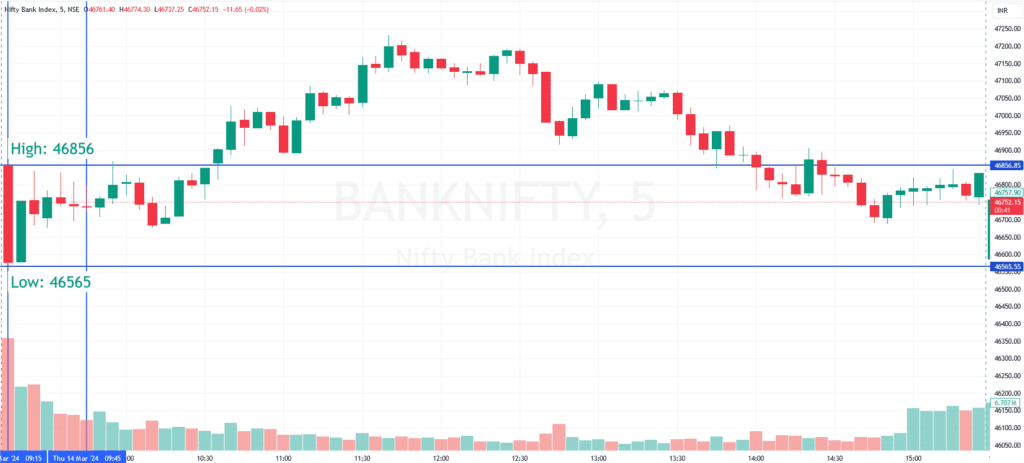

Define the Time Range: Specify the time range during which the algorithm will identify the high and low prices to establish the range. As per your instructions, this range will be from 9:15 am to 9:45 am.

Record Range High and Low Prices: During the specified time range, record the highest and lowest prices of Bank Nifty. These prices will define the upper and lower boundaries of the range.

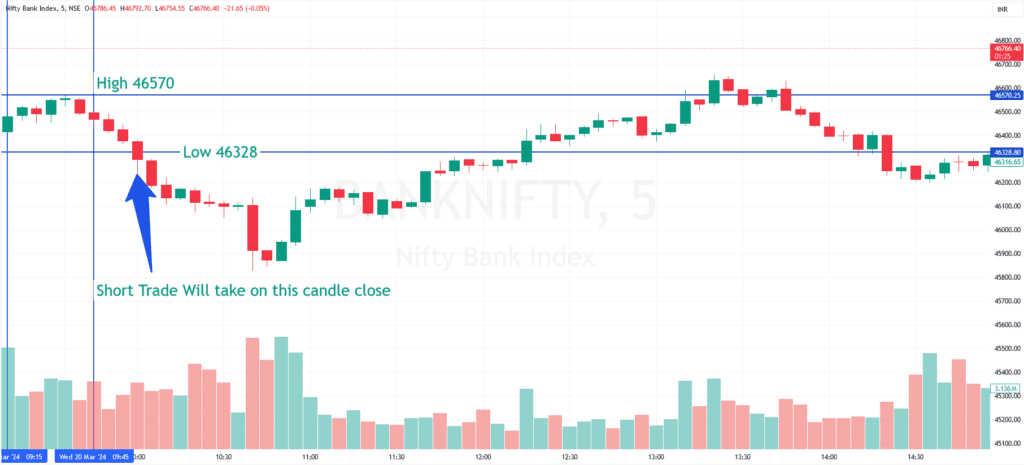

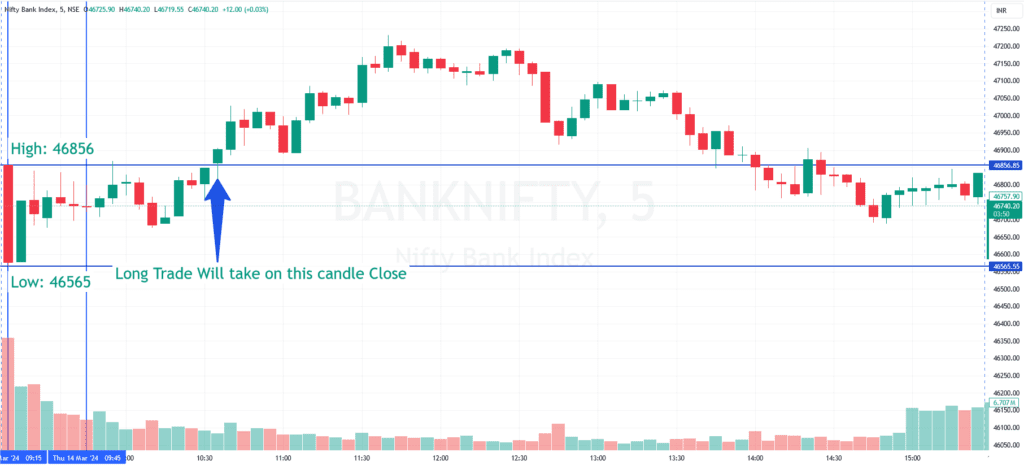

Identify Breakout Conditions: After the time range elapses (9:45 am), monitor the price movement. If the price breaks above the range high, trigger a long trade. If the price breaks below the range low, trigger a short trade.

Set Stop-Loss and Take-Profit Levels: For long trades, set the stop-loss at the range low and determine the take-profit level based on your desired risk-reward ratio (e.g., 1:2). For short trades, set the stop-loss at the range high and calculate the take-profit accordingly.

Execute Trades: Once the breakout conditions are met, execute the corresponding trade (long or short) with the specified stop-loss and take-profit levels.

Monitor the Trade: Continuously monitor the trade for any developments. Adjust stop-loss levels if necessary to manage risk as the trade progresses.

Exit the Trade: Exit the trade when the price reaches the take-profit level, hits the stop-loss, or if you identify signs of a reversal.

Risk Management: Implement proper risk management techniques, such as position sizing and portfolio diversification, to mitigate potential losses.

Review and Refine: Regularly review the strategy’s performance and make necessary refinements to improve its effectiveness over time.

It’s important to thoroughly test the algorithm in a simulated environment before deploying it in live trading to ensure its reliability and effectiveness. Additionally, stay updated with market conditions and adjust the strategy accordingly to adapt to changing market dynamics.

Bank Nifty Range Breakout

Bank Nifty Range Breakout Short Trade

Bank Nifty Range Breakout

Bank Nifty Range Breakout Long Trade

Simple and affordable Pricing

You can purchase our softwares from here using our hassle free payment system.

The products will be activated within just 24 hours of the payment.

Open Account With Us And Get 25% Discount

Download Range Breakout Algo From link

Are you seeking automation for

your trading strategy?

Interested in automating your rule-based trading strategy? Simply Contact Us with the strategy details, and our expert Algo development team will create a custom solution for you.

Your Algo Trading queries answered.

We understand that choosing the right Alog provider is a crucial decision for your trading. To help you make an informed choice, we have compiled a list of common questions asked.

Algorithmic trading, often referred to as algo trading or simply “algo,” is the process of executing trades automatically based on predefined rules or algorithms. These algorithms are designed to analyze market data, such as price movements, volume, and other indicators, and make trading decisions without human intervention. Algo trading can be used in various financial markets, including stocks, forex, commodities, and cryptocurrencies. It aims to remove emotional bias from trading, increase efficiency, and execute trades at optimal prices and times.

Execution occurs locally on your system or cloud server. You’ll install and run the software independently for daily operations.

Certainly, you can validate the strategy logic in paper trading mode before going live. In this mode, the system simulates trades without executing them with the broker. It provides an order book and displays real-time profit and loss (PNL) similar to live trading.

We offer various subscription options for our algo service tailored to your preferences. Please note that refunds are not available under any circumstances.