What is Ratio Spread Option Strategy?

Options trading offers a prime avenue for diversification and securing low-risk profits. Seasoned traders allocate part of their capital to options to diversify their portfolio. Yet, if you’re solely invested in stocks, diving into options trading based solely on intuition for profit is ill-advised.

While options trading stands out as one of the most lucrative asset classes, it’s also intricate. Mastery requires understanding various factors and strategies before venturing into the market. This blog delves into the Ratio Spread strategy, offering insights on leveraging it for profitable investments.

What does the Ratio Spread Options Strategy entail?

The Ratio Spread Options Strategy involves a neutral approach to options trading, where a trader maintains an uneven number of long and short options contracts. The strategy’s core lies in maintaining a specific contract ratio, with the most common ratio being 2:1. For instance, if a trader holds three long contracts, they would have six short contracts, establishing the 2:1 ratio. Similar to other spreads, this strategy utilizes both long and short positions with the same options type, underlying asset, and expiration date, distinguishing itself with its non-1:1 ratio.

What does the Call Ratio Spread strategy entail?

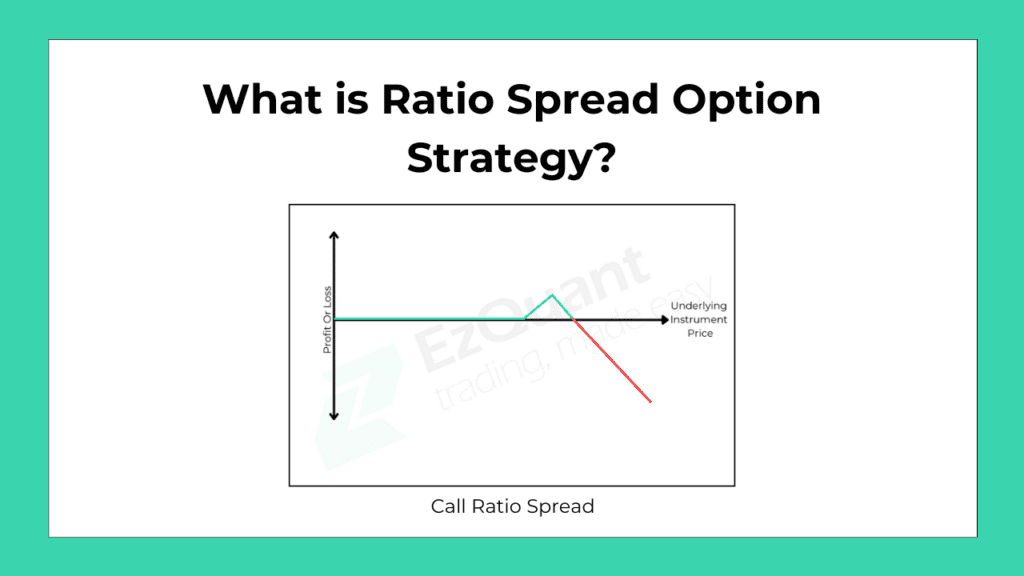

Investors employ two types of spreads within the ratio spread strategy: Call Ratio Spread and Put Ratio Spread. The Call Ratio Spread involves purchasing call options at a lower strike price and selling a higher number of call options at a higher strike price, with the number of contracts bought and sold following a specific ratio.

The concept behind the Call Ratio Spread hinges on the trader’s anticipation of a moderate increase in the underlying asset’s price, potentially reaching only up to the strike price of the sold contracts. Traders primarily utilize this strategy to reduce the initial premium cost they paid. Alternatively, they may use it to receive an upfront credit of premium. A Call Ratio Spread with a 2:1 ratio can be constructed as follows:

- Buy 1 in-the-money call option.

- Sell 2 out-of-the-money call options.

Examples of Ratio Spread

Let’s say you initiate a call ratio spread on ABC stock, which is currently trading at Rs 200, with a three-month expiration date and a lot size of 100 shares. Here’s how the strategy unfolds:

- Buy one call option with a strike price of Rs 210 and a premium of Rs 5 (totaling Rs 500, as Rs 5 x 100).

- Sell two call options with a strike price of Rs 220 and a premium of Rs 3 each (totaling Rs 600, as Rs 3 x 200).

These transactions result in a net credit of Rs 100 (Rs 600 – Rs 500). This represents the maximum profit potential if the stock price falls and remains below Rs 210, causing all contracts to expire worthless. If the stock price is between Rs 210 and Rs 220 at expiry, the trader profits from the option positions and the net credit of the initial premium.

The maximum profit for the trader is achieved if the stock price is Rs 220 at expiry. However, if the price exceeds Rs 220, the trader will incur losses for every point of increase.

In conclusion, the Ratio Spread strategy serves as a neutral approach for traders expecting moderate increases in the underlying asset’s price. However, due to its complexity, it’s essential to thoroughly understand its mechanics before implementation.

You can effortlessly deploy any ratio spread strategy using our Option Strategy Builder on EZWebApp.