Chartink Software : Parameters Walk Through

Strategy Description :

Here is a documentation of all the features provided in the strategy builder :

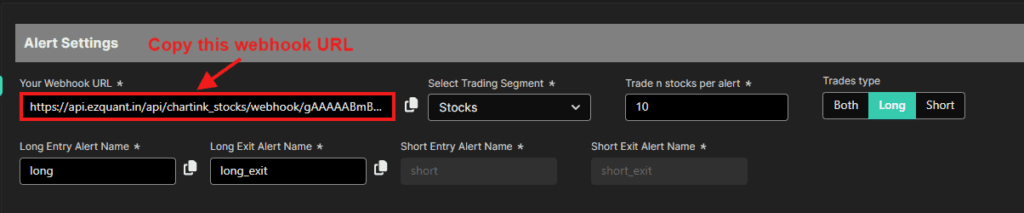

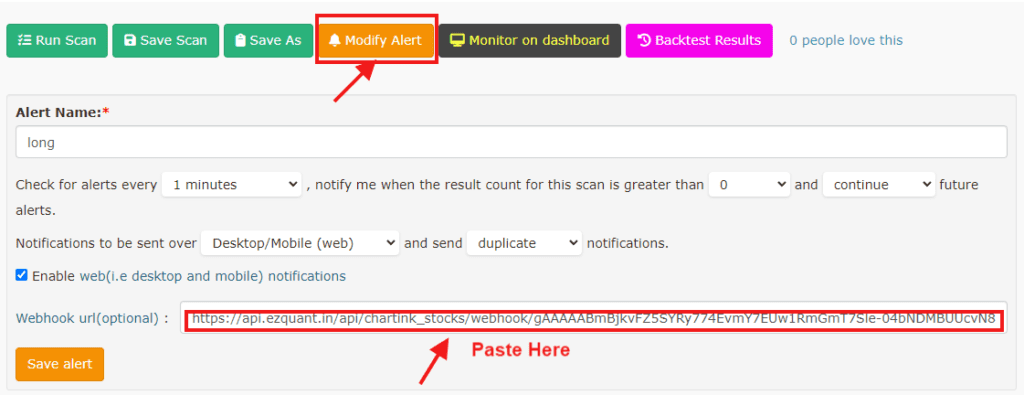

Copy the webhook url in the web app and paste it to your chartink scanner.

Make sure that In Webapp Alert Name and Chartink scanner Alert Name both are same.

Trading Segment : Select the Trading segment of Stocks or stocks future.

Trade n stocks per alert : System will trade only given number of stocks.

Ex: screener gives 10 stocks but you mention only 5 stocks then system will trade only first 5 stocks.

Trades Type : Select the trade type.

- Both : If you want to trade in Long and Short both alert then select Both Button.

- Long : If you want to trade in only buy signals then select Long Alert.

- Short : If you want to trade in only Sell signals then select Short Alert.

Long Entry Alert name : Long alert will take only a long entry from your screener.

Long Exit Alert name : Long exit alert will exit your long trade.

Short Entry alert name : Short alert will take only a Short entry from your screener.

Short Exit alert name : Short exit alert will exit your Short trade.

Entry Parameters :

Order Type : Select order type MIS or NRMl.

Position Sizing :

- Predefined Quantity : For those who want to allocate the same quantity to each scrip.

- Capital management : For those who want to allocate quantity based on predefined capital for each scrip.

- Risk management : For those who want to allocate quantity based on Risk for each scrip.

Max Trade per script : Enter max trade per script.

Entry type : Select the type of your entry between Direct OR Range Breakout.

- Direct : If you select Direct then it will take Direct Trade.

- Range Breakout : If you Select range breakout then it will break out the range and take the trade.

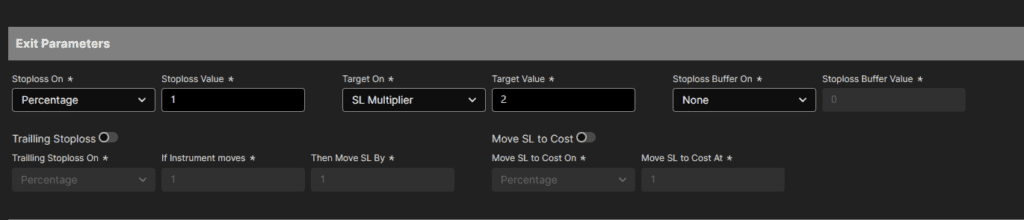

Exit Parameters :

Stop Loss : By default, it is set to No SL. Stop Loss, if required can be specified on basis of :

- Percentage

- Points

Target On : By default, it is set to No target. Target, if required can be specified on basis of :

- Percentage

- Points

- Target Multiplier

Stop Loss Buffer : By default, it is set to No SL Buffer. Stop Loss buffer, if required can be specified on basis of :

- Percentage

- Points

Trailing Stop Loss : By default, it is set to No Trailing Stop Loss. Trailing StopLoss, if required can be specified on basis of :

- Percentage

- Points

Move SL to Cost : If any leg stoploss hits move opposite legs stop loss to cost.

- Percentage

- Points

Strategy Settings :

Start time: Time at which the bot will start receiving signals from chartink and start trading.

End time: Time at which the bot will stop receiving signals and also square off all the existing positions.

No new trade after time : Time at which the bot will stop receiving new signals.

Max Trades : Enter max trades you want to trade.

Stop after n target : Enter the number of Target that you want to stop your strategy.

Stop after n Stop Loss : Enter the number of Stop Loss that you want to stop your strategy.

Deploy on days : Select the Day that you want to trade.

All Days : Click On the All Days Button if you want to trade in All days.

Strategy exit based on MTM (Mark to Market) :

MTM Target : Select MTM Target between Percentage or Points. When MTM Target hits, the algo will immediately exit all open positions.

MTM stoploss : Select MTM Stoploss between Percentage or Stop Loss. When MTM Stoploss hits, the algo will immediately exit all open positions.

Trail Profit :

- For every increase in profit by : Specify the steps at which trailing should happen.

- Trail Lock profits by : Specify the steps by which trailing should happen at every increase in Profit.

If MTM Profit Reaches (X) : This is the MTM at which MTM trailing will start.

Lock profit at (y) : This is the MTM at which MTM Profit will lock.

STRATEGY RUN :

Select among :

Cancel : Clear all the entered parameters and go back to the dashboard.

Save : Save this Strategy.

Save and Deploy : Save and run the Strategy.

Once Save or Save and Deploy is selected, Specify a unique identifiable name to the strategy and select between Paper trading and Live Execution.

In Paper Trading logs are displayed and no orders are punched in the broker account.

In Live Execution logs are displayed and orders are also punched in the broker account.