Understanding the Mechanics of the Strangle Options Strategy

What Is a Strangle?

A strangle is a versatile options strategy where an investor simultaneously holds both a call and a put option with differing strike prices, yet sharing the same expiration date and underlying asset. Employing a strangle can be advantageous when anticipating significant price volatility in the near term but remaining uncertain about the direction of the underlying security. However, its profitability hinges primarily on substantial price swings in the asset.

Compared to a straddle, which utilizes options at the same strike price, a strangle offers a similar approach but with options positioned at varying strike prices.

KEY TAKEAWAYS

- A strangle is a popular options strategy that involves holding both a call and a put on the same underlying asset.

- A strangle covers investors who think an asset will move dramatically but are unsure of the direction.

- A strangle is profitable only if the underlying asset does swing sharply in price.

How Does a Strangle Work?

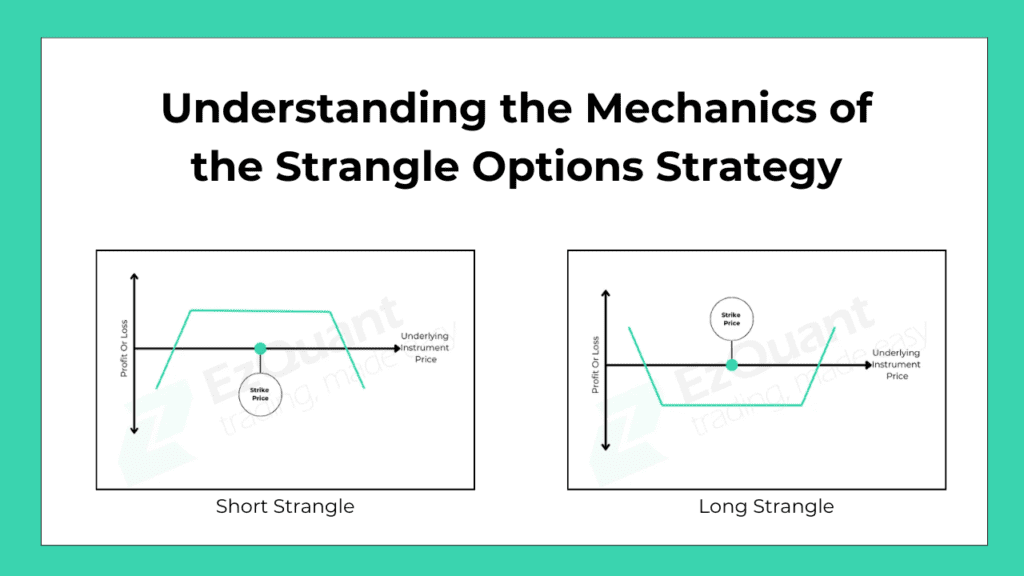

Strangles come in two directions:

Long Strangle:

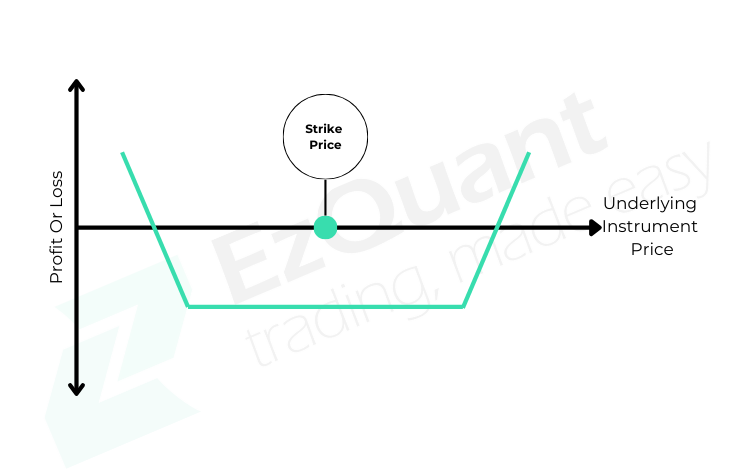

- Long Strangle Strategy: In a long strangle, the investor simultaneously purchases an out-of-the-money (OTM) call option and an out-of-the-money put option on the same underlying asset.

- Strike Prices Selection: The call option’s strike price is typically higher than the current market price of the underlying asset, while the put option’s strike price is typically lower than the current market price. This positioning allows the investor to benefit from significant price movements in either direction.

- Profit Potential: The long strangle strategy offers substantial profit potential. If the underlying asset’s price moves significantly upwards, the call option can generate unlimited profits, as its value increases with the rising price of the asset. On the other hand, if the underlying asset’s price decreases substantially, the put option can also profit, as its value increases with the falling price of the asset.

- Limited Risk: The risk associated with the long strangle strategy is limited to the premium paid for both options. Since the investor is buying both the call and put options, they know upfront the maximum amount they can lose, which is the total premium paid for the options.

- Breakeven Points: For the long strangle strategy to be profitable, the underlying asset’s price must move significantly in either direction to overcome the combined cost of purchasing both options. The breakeven points are calculated by adding or subtracting the total premium paid from the strike prices of the options.

Overall, the long strangle strategy is popular among traders who anticipate substantial price volatility in an underlying asset but are uncertain about the direction of the price movement. It offers a way to potentially profit from significant market swings while limiting the downside risk.

Short Strangle:

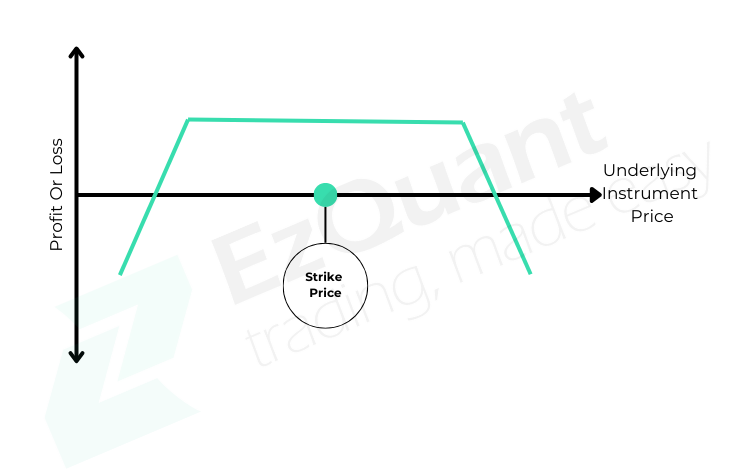

- Short Strangle Strategy: In a short strangle, the investor sells (or “writes”) both an out-of-the-money (OTM) put option and an out-of-the-money call option on the same underlying asset simultaneously.

- Strike Prices Selection: The strike prices of both the put and call options are typically chosen to be outside of the current trading price of the underlying asset. This positioning reflects the expectation that the asset’s price will remain relatively stable within a certain range.

- Neutral Strategy: The short strangle strategy is considered neutral because it profits from a relatively stable or range-bound movement in the underlying asset’s price. The investor benefits from the passage of time and a decrease in the options’ value due to decreasing volatility.

- Limited Profit Potential: Unlike the long strangle strategy, which has unlimited profit potential, the short strangle strategy has limited profit potential. The maximum profit is achieved when the price of the underlying stock trades within a narrow range between the breakeven points. It is equivalent to the net premium received from selling both options, minus any trading costs.

- Breakeven Points: The breakeven points for a short strangle strategy are calculated by adding or subtracting the net premium received from selling both options from the strike prices of the options. These points represent the price range within which the underlying asset’s price can fluctuate while still allowing the investor to break even.

- Risk Management: It’s essential for investors utilizing the short strangle strategy to manage risk effectively. Since the strategy involves selling options, there’s potentially unlimited risk if the underlying asset’s price moves significantly beyond the breakeven points. Risk management techniques such as setting stop-loss orders or using position sizing can help mitigate potential losses.

In summary, the short strangle strategy is a neutral options strategy that profits from stable or range-bound price movements in the underlying asset. It offers limited profit potential but requires careful risk management to protect against potential losses from adverse price movements.

Long Strangle Options Strategy

Short Strangle Option Strategy

Strangle vs. Straddle

While both straddles and strangles allow investors to profit from significant price movements, there are differences in their execution and risk profiles. Buying a strangle, which involves purchasing out-of-the-money call and put options, is generally less expensive than a straddle because the options have lower premiums. However, a strangle requires a larger price movement in the underlying asset to generate a profit, making it riskier than a straddle. Conversely, a straddle involves buying at-the-money options, which are more expensive but require smaller price movements to be profitable.

Profit Mechanism: With both straddles and strangles, investors profit when the price of the underlying asset moves significantly away from the strike price of the options, exceeding the total cost of purchasing the options (for straddles) or the net premium received (for strangles).

Pros:

- Benefits from Asset’s Price Move in Either Direction: A strangle allows investors to profit from significant price movements in the underlying asset, regardless of whether it moves up or down.

- Cheaper Than Other Options Strategies: Compared to strategies like straddles, strangles are generally less expensive because they involve purchasing out-of-the-money options. This lower cost can be appealing for traders looking to enter positions with limited upfront capital.

- Unlimited Profit Potential: The long strangle strategy offers unlimited profit potential. If the underlying asset’s price moves significantly in either direction, the profit potential is theoretically unlimited.

Cons:

- Requires Big Change in Asset’s Price: One of the main drawbacks of a strangle strategy is that it requires a significant change in the price of the underlying asset to be profitable. If the price doesn’t move enough, both options may expire worthless, resulting in a loss for the investor.

- May Carry More Risk Than Other Strategies: While a strangle offers the potential for unlimited profits, it also carries greater risk compared to other strategies. Since it requires larger price movements to be profitable, there’s a higher likelihood of both options expiring worthless if the price doesn’t move significantly.

Real-World Example of a Strangle

Suppose Bank Nifty is currently trading at 35,000 points.

Option Contracts:

- Call Option:

- Strike Price: 36,000 points

- Premium: ₹300 per contract

- Put Option:

- Strike Price: 34,000 points

- Premium: ₹280 per contract

Implementation: The trader decides to employ a strangle option strategy by purchasing one call option and one put option on Bank Nifty, both expiring on the same date.

- Call Option Cost:

- Premium: ₹300 per contract

- Total Cost: ₹300 (assuming one contract)

- Put Option Cost:

- Premium: ₹280 per contract

- Total Cost: ₹280 (assuming one contract)

Outcome Scenarios:

- Price Stays Between 34,000 and 36,000 Points:

- Loss to the trader: Total cost of both option contracts (₹300 + ₹280 = ₹580)

- Price Drops Below 34,000 Points:

- Call Option: Expires worthless, resulting in a loss of ₹300.

- Put Option: Gains value and produces a profit.

- Net Gain/Loss: Depends on the extent of the price drop and the put option’s value.

- Price Rises Above 36,000 Points:

- Put Option: Expires worthless, resulting in a loss of ₹280.

- Call Option: May bring in a profit if the price rise is significant enough to overcome the premium paid.

- Net Gain/Loss: Depends on the extent of the price increase and the call option’s value.

How Do You Calculate the Breakeven of a Strangle?

A long strangle can capitalize on movements in the underlying asset in either direction. Consequently, it entails two breakeven points. These points are computed by adding the strangle’s cost to the call strike and subtracting the strangle’s cost from the put strike.

What Factors Lead to Losses in a Long Strangle Strategy?

In the event that the underlying asset fails to surpass the strike prices, holding a long strangle results in both options expiring worthless, causing the loss of the initial investment made for the strategy.

Comparing the Risk Levels of Straddles and Strangles

Straddles and strangles share similarities, with straddles utilizing both a call and put at identical strike prices, while strangles employ options at different strike prices. Consequently, straddles typically entail higher risk and potential reward compared to strangles, which are generally considered less risky. Additionally, as the gap between the strike prices widens in a strangle, the associated risk/reward ratio tends to decrease.

Conclusion

In conclusion, strangles offer traders a flexible approach to capitalize on anticipated price volatility in the market. Whether employing a long strangle to benefit from significant price movements in either direction or a short strangle to profit from a relatively stable market, this options strategy provides opportunities for traders to navigate various market conditions.

For those seeking to implement strangles or explore other sophisticated options strategies, utilizing an option strategy builder with EzWebApp can streamline the process. By leveraging advanced analytics and customizable parameters, such Option Builder empower traders to construct tailored strategies aligned with their risk tolerance, market outlook, and investment objectives.

Unlock the potential of options trading with our Option Strategy Builder today. Seamlessly design, analyze, and optimize your options strategies to enhance your portfolio performance and achieve your financial goals. Embrace the power of strategic options trading with confidence and precision.