Exploring the Batman Option Strategy: A Thorough Guide

Options, a derivative segment, offer traders opportunities to generate income, manage risk, and hedge against market volatility. Among the array of options strategies tailored to different market conditions, we’ll delve into “The Batman Option Strategy” in this discussion.

What is the Batman Option Strategy?

Options, a derivative segment, offer traders opportunities to generate income, manage risk, and hedge against market volatility. Among the array of options strategies tailored to different market conditions, we’ll delve into “The Batman Option Strategy” in this discussion.

The Batman Option Strategy is employed when an underlying asset is anticipated to remain neutral, devoid of any directional bias. Profitability in this strategy hinges on the underlying security staying within a specific range with minimal movement upon expiration.

Formation

To execute the Batman Option strategy, the following steps are involved in constructing its legs:

- Purchase one out-of-the-money (OTM) call option strike.

- Sell two lots of deep out-of-the-money (OTM) call option strikes.

- Purchase one out-of-the-money (OTM) put option strike.

- Sell two lots of deep out-of-the-money (OTM) put option strikes.

These legs are combined and applied together in the same security with the same expiration date, ensuring that the strike prices are equidistant from each other. The distance of strike prices chosen from the spot price is determined by the expected volatility in the underlying security. Once these legs are assembled, the Batman strategy is deemed to be deployed.

Illustrative Example of the Batman Option Strategy in Action

Understanding the Batman Option Strategy with a Real-Life Example Using Nifty 50

Let’s grasp the construction of the Batman option strategy through a practical scenario. Consider Nifty 50 trading at a spot price of 19,120. We anticipate a significant market movement with high volatility, but the direction remains uncertain. Thus, we opt for the Batman strategy, rounding off the spot price to the nearest strike price, which is 19,100.

Here’s the breakdown of option legs for Nifty 50 at the assumed spot price of 19,120:

First leg: Buy one lot of the 19,300 strike call option, paying a premium of Rs. 20. Second leg: Sell two lots of the 19,350 strike call option, receiving a premium of Rs. 13 each. Since two lots are sold, the total premium received is Rs. 26. Third leg: Buy one lot of the 18,900 strike put option, paying a premium of Rs. 24. Fourth leg: Sell two lots of the 18,850 strike put option, receiving a premium of Rs. 18 each. The total premium received here is Rs. 36. The net premium received is calculated as the sum of premiums received and paid in the option legs. In this example, the net premium amounts to Rs. 18:

Net Premium = (-20 + 26 – 24 + 36) = 18.

Deploying this strategy requires a higher margin compared to other options strategies. In this example, with the received premiums, the margin required is approximately Rs. 1.5 lakhs.

Determining Maximum Profit and Maximum Loss

Achieving Maximum Profit and Understanding Potential Losses in the Batman Option Strategy

When the underlying security reaches the strike price upon expiration, the Batman option strategy reaches its maximum profit potential. This maximum profit can be attained regardless of the direction in which the underlying security moves.

In the scenario where the underlying security expires at the strike price of a short call option, the maximum profit is calculated as follows:

Max Profit = (Strike Price of Short Call) – (Strike Price of Long Call) + (Net Premium Received)

For instance, using the example provided, the maximum profit would amount to Rs. 3400:

Max Profit = (19350 – 19300) + 18 = 68.

Given that the Nifty quantity for 1 lot is 50, the maximum profit for 1 lot of Nifty 50 would be 68 x 50 = Rs. 3400.

Similarly, when the underlying security expires at the strike price of a short put option, the maximum profit is calculated as:

Max Profit = (Strike Price of Long Put) – (Strike Price of Short Put) + (Net Premium Received)

In the same example, the maximum profit also accounts for Rs. 3400:

Max Profit = (18900 – 18850) + 18 = 68.

Again, considering the Nifty quantity for 1 lot as 50, the maximum profit for 1 lot of Nifty 50 would be 68 x 50 = Rs. 3400.

However, it’s essential to recognize that the Batman option strategy carries an unlimited maximum loss potential. This occurs when the market takes a directional movement, causing the spot price to deviate from the strike prices in either direction, resulting in losses upon expiration.

Determining Break-Even Points

The Batman option strategy encompasses two break-even points:

- Upper Break-Even Point: Upper Breakeven Point = (Strike Price of Short Call) + (Difference between Long and Short Call Strike Prices) + (Net Premium Received) For instance, in our example: Upper Breakeven Point = 19350 + 50 + 18 = 19418. If the spot price moves above this point, the strategy initiates incurring a loss upon expiration.

- Lower Break-Even Point: Lower Breakeven Point = (Strike Price of Short Put) – (Difference between Long and Short Put Strike Prices) – (Net Premium Received) For instance, in our example: Lower Breakeven Point = 18850 – 50 – 18 = 18782. If the spot price moves below this point, the strategy commences incurring a loss upon expiration.

Understanding these break-even points is crucial for managing risk and making informed decisions throughout the lifespan of the option strategy.

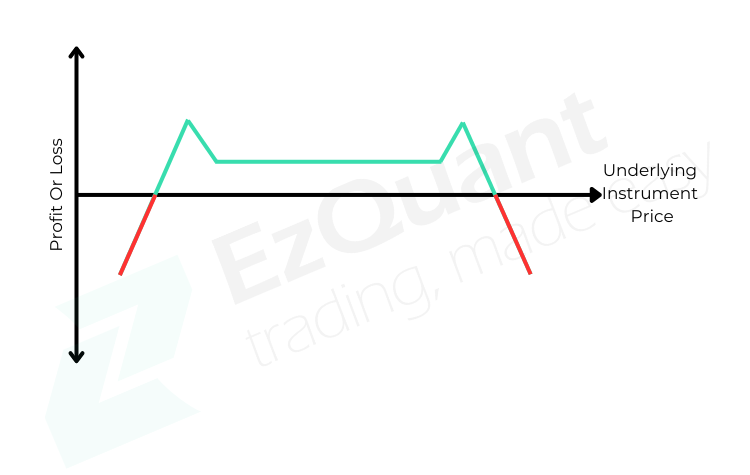

Payoff Graph

Key Insights from the Payoff Chart in the Batman Option Strategy

- Profitable Range:

- If the price of the underlying security expires between the upper break-even and lower break-even points, the strategy yields a profit upon expiry.

- Maximum Profit Peaks:

- The payoff chart typically exhibits two peaks representing maximum profit potential.

- Maximum profit occurs when the underlying security expires at either the short put option strike or the short call option strike.

- Loss Incurrence:

- If the price of the underlying security expires above the upper break-even point or below the lower break-even point, the strategy incurs a loss upon expiry.

Understanding these dynamics is essential for interpreting the payoff chart effectively and managing the Batman option strategy to optimize outcomes while mitigating risks.

Advantages of the Batman Option Strategy

- Profits in Any Direction:

- Generates profits regardless of the direction in which the underlying security moves, as long as it remains within a defined range.

- Suitable for Low to Medium Volatility:

- Ideally suited for markets with low to medium levels of volatility, where the underlying security is expected to exhibit relatively stable movement.

- Flexibility for Adjustment:

- Option legs can be adjusted based on traders’ views on market movements, allowing for greater flexibility and potentially higher profitable ratios.

- Positive Time Decay Effect:

- Time decay, or theta decay, has a positive effect on the strategy due to the presence of more sell option legs than buy legs. This can enhance profitability over time.

- High Probability of Profit:

- Mathematically, the strategy tends to offer a high probability of profit, given its design and the defined range within which it generates profits.

Overall, the Batman Option Strategy presents traders with a versatile approach to capitalize on market movements while effectively managing risk and maximizing potential profitability.

Disadvantages of the Batman Option Strategy

- Reliance on Specific Range:

- The strategy requires the underlying security price to expire within a predetermined range for profitability. If the price moves significantly beyond this range, the strategy may incur losses.

- Unlimited Loss Potential:

- In the event that the market becomes highly directional, the strategy can result in unlimited losses. This occurs when the spot price moves substantially away from the strike prices of the options involved.

- Higher Margin Requirements:

- Compared to some other options strategies, the Batman Option Strategy typically necessitates higher margins. This can tie up more capital, potentially limiting trading opportunities or increasing overall risk exposure.

Understanding these limitations is crucial for traders considering the Batman Option Strategy, as it allows for better risk management and decision-making in options trading.

In conclusion

Having thoroughly explored the intricacies of the Batman options strategy, it’s evident that this approach offers significant potential for traders seeking to capitalize on range-bound markets with high volatility. Moreover, the availability of tools like the EzWebApp Option Strategy Builder streamlines the deployment process, enabling traders to implement the Batman strategy with just a single click. However, it’s important to bear in mind that while the strategy excels in neutral price action scenarios, deviations from the anticipated range can lead to losses. By leveraging such tools effectively and exercising prudent risk management, traders can harness the full capabilities of the Batman strategy and navigate the complexities of options trading more efficiently.